Payback Period Formula with Calculator

It is a measure of how long it takes for a company to recover its initial investment in a project. It is one of the simplest capital budgeting techniques and, for this reason, is commonly used to evaluate and compare capital projects. Financial analysts will perform financial modeling and IRR analysis to compare the attractiveness of different projects. Most capital budgeting formulas, such as net present value (NPV), internal rate of return (IRR), and discounted cash flow, consider the TVM.

Payback Period: Definition, Formula, and Calculation

There are a variety of ways to calculate a return on investment (ROI) — net present value, internal rate of return, breakeven — but the simplest is payback period. Despite these limitations, discounted payback period methods can help with decision-making. It’s a simple way to compare different investment options and to see if an investment is worth pursuing. To calculate discounted payback period, you need to discount all of the cash flows back to their present value. The present value is the value of a future payment or series of payments, discounted back to the present. Delta Company is planning to purchase a machine known as machine X.

Discounted Payback Period: Definition, Formula & Calculation

A young professional decides to contribute to a retirement account, such as a 401(k) or an IRA. This investment decision involves evaluating contribution limits, tax advantages, and investment options within the account. The individual considers their retirement goals and time horizon, deciding how much to invest regularly and which funds or assets to allocate within the retirement account to achieve growth over time. This strategic decision is critical for long-term financial security.

- Unlike net present value , profitability index and internal rate of return method, payback method does not take into account the time value of money.

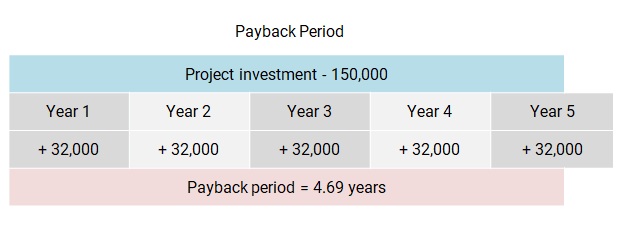

- For example, if it takes five years to recover the cost of an investment, the payback period is five years.

- It is calculated by dividing the investment made by the cash flow received every year.

- That’s why business owners and managers need to use capital budgeting techniques to determine which projects will deliver the best returns, and yield the most profitable outcome.

Irregular Cash Flow Each Year

Perhaps in his case the profit might be worth it, depending on what else is going on in his business. However, it’s likely he would search out another machine to buy, one with a longer life, or shelf the idea altogether. Or the numbers suddenly start fluctuating downwards from year 3 on? Thus, the above are some benefits and limitations of the concept of payback period in excel.

Formula

For instance, a $2,000 investment at the start of the first year that returns $1,500 after the first year and $500 at the end of the second year has a two-year payback period. As a rule of thumb, the shorter the payback period, the better for an investment. Any investments with longer payback periods are generally not as enticing. The Investment Decisions are a core area essential to strategic planning and financial management.

With positive future cash flows, you can increase your cash outflow substantially over a period of time. Depending on the time period passed, your initial expenditure can affect your cash revenue. For example, let’s say you have an initial investment of $100 and an annual cash flow of $20.

Corporations and business managers also use the payback period to evaluate the relative favorability of potential projects in conjunction with tools like IRR or NPV. This period does not account for what happens after payback occurs. Many managers and investors thus prefer to use NPV as a tool for making investment decisions. The NPV is the difference between the present value of cash coming in and the current value of cash going out over a period of time. An individual is considering whether to invest in a mutual fund or directly purchase individual stocks.

In this article, we will explain the difference between the regular payback period and the discounted payback period. You will also learn the payback period formula and analyze a step-by-step example of calculations. When deciding whether to invest in a project or when comparing projects having different returns, a decision based on payback period is relatively complex.

After almost a decade of experience in public accounting, he created MyAccountingCourse.com to help people learn accounting & finance, pass the CPA exam, and start their career. CFI is the global institution behind the financial modeling and valuation analyst FMVA® Designation. CFI is on a mission to enable anyone to be a great financial when does your business need a w analyst and have a great career path. In order to help you advance your career, CFI has compiled many resources to assist you along the path. As you can see in the example below, a DCF model is used to graph the payback period (middle graph below). Get instant access to video lessons taught by experienced investment bankers.

As you can see, using this payback period calculator you a percentage as an answer. Multiply this percentage by 365 and you will arrive at the number of days it will take for the project or investment to earn enough cash to pay for itself. Below is a break down of subject weightings in the FMVA® financial analyst program. As you can see there is a heavy focus on financial modeling, finance, Excel, business valuation, budgeting/forecasting, PowerPoint presentations, accounting and business strategy. Since IRR does not take risk into account, it should be looked at in conjunction with the payback period to determine which project is most attractive. As a general rule of thumb, the shorter the payback period, the more attractive the investment, and the better off the company would be.

It is important for players in the financial market to understand them clearly so that they can be used appropriately as and when required and get the benefit of it to the maximum possible extent. In this guide, we’ll be covering what the payback period is, what are the pros and cons of the method, and how you can calculate it, with concrete business examples. Ideally, businesses would pursue all projects and opportunities that hold potential profit and enhance their shareholder’s value. However, there’s a limit to the amount of capital and money available for companies to invest in new projects. The first column (Cash Flows) tracks the cash flows of each year – for instance, Year 0 reflects the $10mm outlay whereas the others account for the $4mm inflow of cash flows.

Categories

- ! (1)

- ! Без рубрики (67)

- 0xprocessing (1)

- 1 (58)

- 1 win (5)

- 10000sat7 (3)

- 10005sat (4)

- 10060sat (2)

- 10125_sat (8)

- 10170_sat (1)

- 10200_prod2 (3)

- 10200_sat2 (2)

- 10200_tr (5)

- 10300_wa (3)

- 10300sat (6)

- 10310_sat (1)

- 10350_tr (5)

- 10350tr (4)

- 10390_sat (1)

- 10400_prod3 (1)

- 10400_sat (1)

- 10500_sat (5)

- 10500_sat3 (5)

- 10500_wa2 (4)

- 10500_wa4 (2)

- 10600_prod2 (5)

- 10650_tr (3)

- 10700_sat (2)

- 10700_wa (3)

- 10800_prod (2)

- 10800_tr (4)

- 10831_wa (7)

- 11 (1)

- 11000prod2 (4)

- 1121 (33)

- 11380_wa (4)

- 11400_wa (6)

- 1win (7)

- 1win Azərbaycan (2)

- 1Win Brasil (9)

- 1win Brazil (13)

- 1win casino (3)

- 1win casino spanish (8)

- 1win fr (5)

- 1win India (12)

- 1win Login 259 (4)

- 1WIN Official In Russia (7)

- 1win Turkiye (20)

- 1win uzbekistan (14)

- 1winRussia (9)

- 1xbet apk (7)

- 1xbet Korea (7)

- 1xbet KR (6)

- 1xbet malaysia (4)

- 1xbet Morocco (4)

- 1xbet pt (5)

- 1xbet russia (6)

- 1xbet Russian (6)

- 1xbet-1 (1)

- 1xbet-bangl.com (1)

- 1xbet-malaysia.com (1)

- 1xbet1 (4)

- 1xbet2 (3)

- 1xbet3 (1)

- 1xbet4 (2)

- 1xbet5 (2)

- 1xbet6 (1)

- 1xbet7 (2)

- 1xBetBangladesh (1)

- 1xbetbk.wiki (1)

- 2 (20)

- 20 Bet Casino 263 (3)

- 20bet Kasyno 411 (3)

- 22 Bet (4)

- 222 (10)

- 22bet (4)

- 240682 15.01.2025 (5)

- 320 (8)

- 33level.ru 500 (1)

- 4 (1)

- 44 (2)

- 444 (2)

- 5 (1)

- 5-7 (1)

- 555 (7)

- 6 (1)

- 77777777 (1)

- 777777777 (2)

- 7gold-casino.co.uk (3)

- 7k casino (5)

- 8298_prod (8)

- 8600_tr2 (4)

- 88 (1)

- 9 (2)

- 913 (0)

- 9500_wa2 (3)

- 9600_prod3 (2)

- 9600_sat (1)

- 9617_tr (8)

- 9835_sat (5)

- 9870_sat (2)

- 9900_sat (2)

- 9950_prod (0)

- 9985_sat (2)

- 9990_tr (8)

- a16z generative ai (4)

- a16z generative ai 1 (2)

- Abuking.info_July (1)

- Adaptation (1)

- adobe generative ai 1 (4)

- adobe generative ai 3 (7)

- affdays (1)

- Ai Art Generator Meme 765 (3)

- ai bot name 2 (3)

- AI News (8)

- amigowinscasino.com (1)

- amminex.net 2 (1)

- anabolics (1)

- ancor zebroid all (1)

- ancorallZ (11)

- ancorallZ 1000 (1)

- ancorallZ1250 (1)

- ancorallZ500 (2)

- anomaly-power (1)

- anonymous (3)

- answers (1)

- apokrifpodcast.com 1000 (1)

- articles (5)

- Asino.casino_July (1)

- Asino.cc_Apr_1w (3)

- Asino.cc_may_1 (1)

- Asino.club_July (1)

- Asino.online_Apr_1w (1)

- Asino.online_May_1w (2)

- Asino.pro_Apr_1w (4)

- Asino.pro_July (1)

- Asino.pro_May_1w (1)

- Asinoaustria.com_08.04.25 (2)

- Asinoaustria.com_May1 (1)

- Asinocanada.com_Apr_1w (3)

- Asinocanada.com_May_1w (1)

- Asinocasino.com_Apr_1w (5)

- Asinocasinoaus.com_Apr_1w (4)

- Asinocasinoaus.com_Feb_4w (5)

- Asinocasinoaus.com_May_1w (3)

- Asinokasino.com_Feb_4w (3)

- augustent.com 2 (1)

- Avia (1)

- Aviator (7)

- aviator (3)

- aviator brazil (8)

- aviator casino fr (4)

- aviator ng (3)

- avis plinko (1)

- axiomaltd.ru 500 (1)

- bagsyoulike.ru 500 (1)

- Bankobet (10)

- Basaribet (5)

- bashpirat.ru 2000 (1)

- baunti.xyz (1)

- bbrbet colombia (5)

- bbrbet mx (10)

- BC Game (7)

- bc5 (1)

- bcg5 (1)

- bcgame-hindi.com (2)

- bcgame1 (4)

- bcgame2 (6)

- bcgame3 (8)

- bcgame4 (5)

- bcgame5 (1)

- bcgame6 (4)

- bcgame7 (1)

- Bdm Bet Codigo Promocional 176 (3)

- Bdm Bet Promo Code 230 (0)

- Bdmbet Casino 336 (3)

- berkeleycompassproject1 (1)

- Best Online Casinos & Pokies (4)

- Best rated casino (1)

- bestappstrading.com (6)

- bestbinary (1)

- bestbrokercfd.com (1)

- beste casino zonder cruks (4)

- bet-12 (3)

- bet-13 (0)

- bet1 (11)

- bet13 (1)

- bet2 (11)

- bet20 (1)

- Bet20 Casino 15 (1)

- bet3 (6)

- bet4 (5)

- bet5 (1)

- betandreas-czechia.com (3)

- Betfast Io Login 44 (3)

- Betnacional (2)

- Betnacional oficial (1)

- BETT (1)

- betting (11)

- betting5 (1)

- bettt (1)

- Betway Login India 275 (4)

- betwinner (2)

- betwinner-brasil.net (2)

- betwinner1 (6)

- betwinner2 (3)

- betwinner3 (3)

- betwinner4 (1)

- bizzo casino (5)

- Blaze Apostas Entrar Login 288 (3)

- blog (105)

- BloodySlots Casino (1)

- bonanzareels (1)

- book of ra (4)

- Bookkeeping (24)

- Brazil slots (1)

- buitenlandse goksites zonder cruks (3)

- Buy Semaglutide (4)

- casibom tr (5)

- casino (68)

- casino 7k (6)

- Casino Australia (1)

- casino buitenland (1)

- Casino Days Nz 170 (3)

- casino en ligne (11)

- casino en ligne fiable (1)

- casino en ligne fiable23 (3)

- casino en ligne fr (4)

- casino en ligne francais (4)

- casino en ligne francais2 (2)

- casino en ligne france (4)

- casino en ligne france légal (1)

- casino en ligne11 (1)

- casino en ligne2 (1)

- casino en línea (13)

- casino francais en ligne (4)

- casino francais en ligne13 (1)

- Casino games (0)

- casino gratuit en ligne (1)

- casino onlina ca (10)

- casino online (10)

- casino online 1win (6)

- casino online ar (12)

- casino online buitenland (2)

- casinò online it (9)

- Casino slots (1)

- casino zonder crucks netherlands (5)

- casino zonder cruks (3)

- casino zonder cruks nederland (2)

- casino-1 (1)

- casino-11 (1)

- casino-12 (1)

- casino-14 (1)

- casino-16 (1)

- casino-18 (1)

- casino-19 (1)

- casino-4 (1)

- casino-6 (0)

- casino-9 (1)

- casino-casiny (1)

- casino-glory india (5)

- casino1 (19)

- casino10 (2)

- casino11 (1)

- casino12 (2)

- casino13 (3)

- casino14 (3)

- casino15 (2)

- casino16 (5)

- casino17 (4)

- casino18 (1)

- casino19 (2)

- casino2 (10)

- casino21 (1)

- casino22 (2)

- casino23 (1)

- casino25 (2)

- casino26 (1)

- casino3 (14)

- casino30 (1)

- casino4 (8)

- casino5 (6)

- casino6 (1)

- casino7 (2)

- casino8 (2)

- casino9 (3)

- Casinoandyou.apro (1)

- casinohrvatska (1)

- Casinologinaustralia.org (1)

- Casinologinaustralia.org_April_1w (2)

- Casinologowaniea.net_08.04.25 (2)

- Casinologowaniea.net_May_1 (1)

- Casinoly casino (2)

- casinos not on gamstop (4)

- cassino online (10)

- cat-casino3.store (1)

- cat-kazino.cyou (1)

- catcazinos.art (1)

- cazino24 (1)

- Cbd Oil For Dog Seizures 813 (0)

- CCCCCCC (1)

- chat bot names 4 (1)

- CheckBasinas (4)

- Co-Owners (1)

- Co-working Spaces (7)

- Como Registrarse Gratogana 932 (1)

- Content (1)

- crazy time (5)

- Crickex App Login 426 (5)

- cryptcasino (1)

- Cryptoboss Сasino (4)

- Cryptocurrency service (13)

- csdino (6)

- dallaspalms.com (1)

- DE 2000_qvg3djyqbp (1)

- developmentspb.ru 10 (1)

- Digital (1)

- Divaspin-casino.com (1)

- done 15381 (5)

- dorogibezproblem.ru 500 (1)

- ð¦ðÁðÀÐûð+ðÁð¢ð¢ð¦ ð+ð¦ð+ð¦ð¦ 3 (2)

- ð¥ð¢ð╗ð░ð©╠åð¢ ð║ð░ðÀð©ð¢ð¥ ð┐ð¥ð╗ÐîÐêð░ (4)

- e-Kitap Depolama (8)

- exbroke1 (1)

- exbroker1 (1)

- exness1 (1)

- exness2 (2)

- exness3 (2)

- Extra (1)

- extrade2 (1)

- extradition (1)

- ez-grow.ru 500 (1)

- Fair play casino (1)

- Fairplay Club 154 (9)

- FairSpin (3)

- farma1 (1)

- farma4 (1)

- farmacia2 (1)

- farmaciadireta (2)

- Fat Boss Casino 496 (6)

- fcliverpool24.ru (1)

- fcommunity.ru (2)

- Financial Marketplace in the USA (9)

- FinTech (20)

- Fonbet (1)

- Forex Trading (27)

- fr (2)

- Free slot games (0)

- freespins (1)

- Fun88 Live 311 (1)

- Galactic Wins Casino Login 331 (4)

- Gama Casino (6)

- Gambling (16)

- Gambling games (1)

- games (8)

- general (7)

- generative ai application landscape 1 (4)

- glory-casinos tr (5)

- GO (1)

- go-pocket-option.com (1)

- goldfishcasino (2)

- guide (5)

- Hacks for job seekers (1970)

- hd porn (4)

- Headhunting (21)

- hello-france.ru 500 (1)

- Hot News (1)

- HR Jobs (10)

- in-mostbet-casino.com (2)

- inasound.ru (1)

- inbet bg (2)

- indon-1xbe1.com (1)

- info (6)

- innovaforum.ru 300 (1)

- Is Hemp Oil The Same As Cbd Oil 396 (5)

- IT Education (8)

- IT Vacancies (8)

- IT Вакансії (18)

- IT Образование (12)

- IT Освіта (4)

- italyanmutfagihaftasi.com 2 (1)

- ivermectina (1)

- ivpokrov.ru 300 (1)

- jaya9 (1)

- jaya92 (1)

- jeetsbuzz.com (1)

- Jetton KZ (1)

- Jetton RU (1)

- Just for fun (8)

- kaktus-casino.click (1)

- kaktus-casino.ink (1)

- kaktuz-casino.wiki (1)

- KaravanBet Casino (11)

- Kasyno Online PL (7)

- kgskouskosh3.ru 4000 (1)

- king johnnie (7)

- Kraken Metatrader 641 (3)

- kristinafrolova.ru 500 (1)

- Kudos Casino No Deposit Bonus 658 (3)

- kvatroplus.ru 500 (1)

- ledger live (7)

- legaleanabolen (1)

- legalsteroids (1)

- legjobbmagyarcasino.online (1)

- lera 123 (10)

- Licensed online casino (1)

- livecasinoz (4)

- Local News (1)

- luckhome.ru 2000 (1)

- lucky jet (4)

- lucky-star1 (2)

- lucky123casinoindi.org (1)

- luckymaxgames.com (0)

- luckystarcasino (1)

- lyakarnaval.ru 1000 (1)

- main (4)

- mandarin-oriental.ru (1)

- Maribet casino TR (5)

- Masalbet (4)

- meilleur casino en ligne (3)

- meilleur casino en ligne france (1)

- metabet18 (2)

- minaevlive.ru (1)

- misc (4)

- Mobile casino games (1)

- Mostbet (12)

- Mostbet Aviator 256 (2)

- Mostbet Football Schedule Live Sports Streaming Online" - 6 (6)

- mostbet italy (4)

- Mostbet Kazino 917 (3)

- mostbet ozbekistonda (5)

- Mostbet Russia (14)

- Mostbet Synopsis Live Sports, Gambling Odds Api - 527 (3)

- mostbet tr (9)

- mostbet-2 (1)

- mostbet-4 (1)

- mostbet-5 (1)

- mostbet-official.co.in (1)

- mostbet1 (1)

- mostbet3 (0)

- mostbetmobile (1)

- Mr Bet casino DE (3)

- mx-bbrbet-casino (5)

- New folder (11)

- New folder (2) (4)

- New online casinos (1)

- News (1269)

- ninewin-casino.com (1)

- normel-spb.ru 2500 (1)

- nouveau casino en ligne11 (1)

- Novibet (2)

- Novibet Apostas Esportivas 167 (3)

- nowe-kasyna (1)

- olginskaya-aksay.ru (1)

- olympusslots (1)

- Onabet Oficial 9 (3)

- online casino (32)

- online casino au (8)

- online casino nederland zonder cruks (2)

- Online casino slots (1)

- online casino zonder cruks (3)

- online casinos buitenland (1)

- onlone casino ES (5)

- OOOOOO (1)

- other (2)

- Our proven partners (2)

- ozwin au casino (7)

- Ozwin Online Casino One Hundred Free Spins No Downpayment On Money Bandits 3 - 738 (11)

- Pablic (20)

- pages (11)

- Parimatch Betting 481 (4)

- Partners (1)

- Partycasino Bono 592 (5)

- Partycasino Bonus Code 10€ 953 (2)

- Partycasino Entrar 321 (3)

- Partycasino Opiniones 908 (3)

- PDF eBooks Kulübü (7)

- pelican casino PL (6)

- Pin UP (7)

- Pin Up Brazil (5)

- Pin Up Casino (9)

- Pin Up Peru (10)

- pinc0.art (1)

- pinco (18)

- Pinco Bahis 358 (4)

- pinco25.xyz (1)

- pinko.pics (1)

- Pinup Login 125 (4)

- Planbet-portugal.com_May3 (2)

- Planbet-pt.net_May3 (1)

- Planbet.biz_May3 (1)

- Planbet.casino_May3 (2)

- Planbet.one_May3 (3)

- Planbet.plus (1)

- Planbet.space (2)

- Planbet.space_08.04.25 (2)

- Planbet.space_may_1 (2)

- Planbetbangladesh.net (1)

- Planbetlive.com_May3 (1)

- Planbetlogin.com_May3 (1)

- Planbetlogin.org_May3 (1)

- Planbetpt.com_May3 (1)

- Plangames-nz.com_Apr_1w (4)

- Plangames-nz.com_May_1w (1)

- Plangames.cool (4)

- Plangames.cool_08.04.25 (3)

- Plangames.cool_May1 (2)

- Plangames.io_May (2)

- Plangames.io_May_1w (1)

- Plangames.net_May1 (1)

- Plangamescasino.co (3)

- Plangamescasino.co_08.04.25 (2)

- Plangamescasino.co_13.05.25 (4)

- Plangamescasino.info (4)

- Plangamescasino.info_Apr_1w (1)

- Plangamescasino.info_May1w (1)

- Plangamesfinland.com_May_1w (1)

- Plangamesigralnica.com (3)

- Plangamesigralnica.com_08.04.25 (4)

- Play Croco Login 914 (3)

- Playcroco Online Casino 899 (4)

- Playfina.info_Apr_1w (2)

- Playfina.info_Apr1 (1)

- Playfina.org_May1 (2)

- Playfinawin.com_Apr_1w (3)

- Playfinawin.com_May_1w (3)

- playpoker-ru.ru (1)

- plinko (18)

- plinko 2 (1)

- plinko balls (4)

- plinko balls 2 (1)

- plinko casino1 (1)

- Plinko fr (3)

- plinko gambling 2 (2)

- plinko in (6)

- plinko_pl (4)

- Plinko3 (1)

- Pocket (5)

- pocket-option.live (1)

- pocket-option2 (1)

- pocket-option3 (1)

- pocket1 (1)

- pocketoption-platform.com (0)

- pocketoption3 (1)

- poker.ok-play-poker.click (1)

- poker.play-online-ok.store (1)

- pokerdom (1)

- Post (561)

- posts (8)

- PPPPPPP (1)

- pragmaticplaykorea (1)

- press (6)

- primadvd (0)

- primexbt2 (1)

- Providers (1)

- Public (7)

- Public-post (6)

- Publication (7)

- Qizilbilet (6)

- Queen777 App 746 (3)

- r7-casinoz.life (1)

- r7-cazinos.xyz (1)

- r7caz.pro (1)

- r7kaz.live (1)

- r7win.wiki (1)

- r7win.xyz (1)

- rahmennummern-check.de (1)

- Ramenbet (6)

- ready_text (2)

- Real money slots (1)

- Recruitment (46)

- reviews (11)

- ricky casino australia (7)

- riobet-casinos.pro (1)

- riobet2025.xyz (1)

- riobet5.pro (1)

- RRRRRR (1)

- RRRRRRR (4)

- RRRRRRRR (2)

- rybelsus (5)

- SBOBET1 (1)

- se (8)

- sh18.ru (1)

- Sky247 Apk 684 (2)

- Slots (12)

- Slots online (1)

- slotsoffortune (1)

- slottica (4)

- Slottica 38 Mogą Liczyć - 128 (6)

- Slottica 69 Darmowy Bonus Dla Ciebie - 616 (6)

- Slottica Bonus Bez Depozytu 2022 Nos Melhores - 117 (9)

- Slottica Casino Pl 120 (2)

- Slottica Casino Pl Best Casino Game To Win Money - 335 (3)

- Slottica Co To Gry Sloty - 813 (4)

- Slottica Como Sacar Canadas Best Online Casino - 425 (4)

- Slottica Descargar Live Dealer Casino Uk - 955 (10)

- Slottica Kz Naszej Strony - 151 (6)

- Slottica Kz Żywo Z Prawdziwymi - 686 (5)

- Slottica Logowanie 330 (3)

- Slottica Usuwanie Konta Automaty Gry Stołowe - 849 (9)

- Slottica Zaloguj Moon Graj - 880 (4)

- smartline93.ru 4-8 (1)

- Sober Living (15)

- Sober living (7)

- Sociomovens.pl_July (1)

- soft2 (1)

- soft2bet (1)

- Software development (15)

- Something Such As 20 Free Spins Without A Down Payment At Ozwin On Range Casino - 723 (8)

- Spinline-es.com_08.04.25 (3)

- Spinline-es.com_may_1 (3)

- Spinline-greece.com_May (1)

- Spinline-nz.com_Apr_1w (6)

- Spinline-nz.com_May_1 (1)

- Spinline.casino_May1 (2)

- Spinline.club_Apr_1w (4)

- Spinline.club_May_1w (1)

- Spinline.info_08.04.25 (2)

- Spinline.io_Apr_1w (9)

- Spinline.io_May_1w (1)

- Spinline.me_Apr_1w (3)

- Spinline.me_may_1w (1)

- Spinline.one_Apr_1w (2)

- Spinline.one_May_1 (1)

- Spinlineaustria.com (4)

- Spinlineaustria.com_08.04.25 (2)

- Spinlineaustria.com_May1 (2)

- Spinlinefinland.com_May_1w (1)

- Spinlineigralnica.com (4)

- Spinlinenorway.com (6)

- Spinlinenorway.com_08.04.25 (3)

- Spinlineswiss.com_May_1w (1)

- Sponsors (1)

- Spread (1)

- Stake Casino (7)

- Start today (2)

- StarzBet Casino (6)

- steroide (3)

- steroides (2)

- steroidi (1)

- steroidilegali (1)

- steroids (1)

- stomat2 (1)

- Stone-vegas-casino.com (1)

- Stone-vegas.biz (1)

- Stone-vegas.cc_may1 (2)

- Stone-vegas.com_May1 (2)

- Stone-vegas.fun_May_1w (2)

- Stone-vegas.org (1)

- Stone-vegas.vip_May1 (1)

- Stone-vegas.win_May_1w (3)

- Stonevegas-pt.com_May1 (2)

- Stonevegas.biz (1)

- Stonevegas.casino_May1 (2)

- Stonevegas.cc (1)

- Stonevegas.fun_May1 (1)

- Stonevegas.live (1)

- Stonevegas.me_Apr_4w (4)

- Stonevegas.me_may1 (2)

- Stonevegas.online (1)

- Stonevegas.org_May1 (2)

- Stonevegasdeutsch.com_May_1 (2)

- Stonevegasgreece.com_may1 (2)

- Stonevegashu.com_May_1w (1)

- Stonevegashungary.com_May_1w (1)

- Stonevegaskasino.com (1)

- Stonevegasnorway.com (1)

- stories (4)

- Strategies (1)

- stromectol (2)

- sugar rush (6)

- sugarrushslots (1)

- super-fundament.ru 700 (1)

- sweet bonanza TR (2)

- swipey (1)

- taya365 casino (5)

- The History of the Maya Civilization (3)

- TOP (4)

- Top online casinos (1)

- trader3 (3)

- trading (1)

- Trading1 (1)

- trading4 (1)

- trading5 (2)

- trading6 (1)

- transferdmc (1)

- Trump coin (4)

- Trusted casino sites (1)

- TTTTTTT (7)

- uncategorized (36)

- Unlim казино (8)

- updates (6)

- Uptime (1)

- UUUUUU (1)

- Vegasino Login 332 (3)

- vegastars1 (1)

- vegastars3 (1)

- verde casino hungary (5)

- verde casino poland (4)

- verde casino romania (4)

- verin-tennis.rublogtop-tennisistov-vseh-vremen-i-narodov 20 (1)

- veyorum.com 2000 (1)

- Vietnam Casino (1)

- vodka-zerkalo.ru 5 (1)

- Vovan Casino (6)

- vulcn.pro 2000 (1)

- vulkn.space 2000 (1)

- Wash Service 322 (2)

- Wazambakasyno.com (1)

- What Is Tge In Crypto 213 (2)

- wikini (2)

- Winspark 50 Giri Gratis 405 (3)

- wireplay (2)

- wowbet (2)

- YYYYYYY (2)

- YYYYYYYYY (1)

- zenginsozluk.com (1)

- Ауф казино (5)

- водка казино (7)

- займы онлайн (6)

- казино онлайн польша (2)

- Комета Казино (8)

- Криптобосс казино (3)

- Новости (1)

- Обновления (1)

- Прогон_asinoonline.com_08.04.25 (2)

- Прогон_asinoonline.com_13.05.25 (1)

- Прогон_plangames.co_08.04.25 (3)

- Прогон_plangames.co_13.05.25 (1)

- Прогон_spinline.win_13.05.25 (1)

- Финтех (7)

- Форекс Брокеры (13)

- Форекс обучение (15)

- Форекс Обучение (0)

- Швеция (14)

- 온라인 카지노 사이트 (9)